What Is Life Insurance?

insurance may be a contract between AN nondepository financial institution and a policy owner. A life insurance policy guarantees the insurer pays a total of cash to named beneficiaries once the insured dies in exchange for the premiums paid by the client throughout their lifetime.

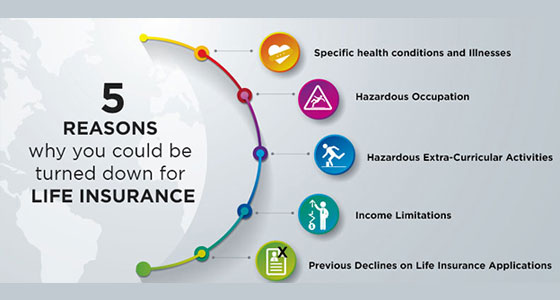

The life insurance application should accurately disclose the insured’s past and current health conditions and speculative activities to enforce the contract.

KEY TAKEAWAYS

• insurance is a wrongfully binding contract that pays a benefit to the policy owner when the insured dies.

• For a life insurance policy to stay in force, the client should pay one premium up front or pay regular premiums over time.

• once the insured dies, the policy’s named beneficiaries can receive the policy’s face value, or death benefit.

• Term insurance policies expire when a particular range of years. Permanent life insurance policies remain active till the insured dies, stops paying premiums, or surrenders the policy.

Also Read: NETWORK MARKETING IS NOWADAYS

• A life contract is simply nearly as good because the monetary strength of the corporate that problems it. State warranty funds might pay claims if the institution can’t.

kinds of insurance

many alternative types of life insurance are on the market to fulfill all sorts of wants and preferences. looking on the short- or long-run needs of the person to be insured, the most important alternative of whether or not to pick out temporary or permanent life insurance is very important to consider.

Term life insurance

Term life insurance lasts a particular range of years, then ends. you select the term once you eliminate the policy. Common terms are 10, 20, or thirty years. the most effective term life insurance policies balance affordability with long-term monetary strength.

• Decreasing Term Life Insurance—decreasing term is renewable term insurance with coverage decreasing over the lifetime of the policy at a preset rate.

• Convertible Term Life Insurance—convertible term life insurance permits clients to convert a term policy to permanent insurance.

• Renewable Term Life Insurance—is a yearly renewable term life policy that has a quote for the year the policy is purchased. Premiums increase annually and are typically the smallest amount pricy insurance within the beginning.

Permanent life insurance

Permanent life insurance stays effective for the insured’s entire life unless the policyholder stops paying the premiums or surrenders the policy. It’s usually dearer than term.

• Whole Life—whole insurance may be a sort of permanent life insurance that accumulates money worth. Cash-value life insurance permits the client to use the cash value for several purposes, appreciate a supply of loans or cash or to pay policy premiums.

• Universal Life (UL)—a type of permanent life insurance with a cash value part that earns interest. Universal life options versatile premiums. in contrast to term ANd whole life, the premiums may be adjusted over time and designed with tier benefit or an increasing death benefit.

• Indexed Universal (IUL)—this may be a sort of universal insurance that lets the client earn a set or equity-indexed rate of come on the money worth component.

• Variable Universal (VUL)—with variable universal life insurance, the policyholder can invest the policy’s cash value in an on the market separate account. It additionally has versatile premiums and may be designed with tier benefit or an increasing death benefit.

Term vs. Permanent insurance

Term life insurance differs from permanent life insurance in several ways however tends to best meet the wants of most people. Term insurance solely lasts for a group amount of your time and pays a benefit should the client die before the term has expired. Permanent life insurance stays in impact as long because the policyholder pays the premium. Another crucial distinction involves premiums—term life is usually much more cost-effective than permanent life as a result of it doesn’t involve building a money value.

Before you apply forever insurance, you must analyze your monetary state of affairs and confirm what quantity money would be needed to take care of your beneficiaries’ commonplace of living or meet the requirement that you’re getting a policy.

For example, if you’re the first caretaker and have kids two and four years old, you’d need enough insurance to hide your guardian responsibilities till your kidren are grownup up and ready to support themselves.

you may analysis the price of hiring a nanny and a domestic or victimization industrial child care and a improvement service, then maybe add some cash for education. embrace any outstanding mortgage and retirement wants for your domestic partner in your insurance calculation. particularly if the spouse earns considerably less or may be a stay-at-home parent. Add up what these prices would be over succeeding sixteen approximately years, add a lot of for inflation, and that’s the benefit you may need to buy—if you’ll afford it.

Burial or final expense insurance is a sort of permanent insurance that encompasses a tiny death benefit. Despite the names, beneficiaries can use the death benefit as they wish.

what quantity insurance to shop for

several factors can have an effect on the price of life insurance premiums. bound things could also be on the far side your control, however different criteria can be managed to doubtless bring down the price before applying.

when being approved for an insurance policy, if your health has improved and you’ve created positive life-style modifications, you’ll request to be thought-about for change in risk class. though it’s found that you’re in poorer health than at the initial underwriting, your premiums won’t go up. If you’re found to be in higher health, then you can expect your premiums to decrease.

STEP one – confirm what quantity you would like

have confidence what expenses would want to be coated within the event of your death. Things like mortgage, faculty tuition, and different debts, to not mention ceremony expenses. Plus, financial gain replacement may be a major issue if your domestic partner or idolized ones would like income and don’t seem to be ready to give it on their own.

There are useful tools on-line to calculate the payment that may satisfy any potential expenses that may got to be covered.

What Affects Your insurance Premiums and Costs?

STEP two – Prepare Your Application

Investopedia / Lara Antal

• Age: this can be the foremost vital factor as a result of lifespan is that the biggest determinant of risk for the insurance company.

• Gender: as a result of ladies statistically live longer, they often pay lower rates than males of an equivalent age.

• Smoking: an individual who smokes is in danger for several health problems that would shorten life and increase risk-based premiums.

• Health: Medical exams for many policies embrace screening for health conditions like heart sickness, diabetes, and cancer and connected medical metrics that may indicate risk.

• Lifestyle: Dangerous lifestyles can create premiums rather more expensive.

• Family medical history: If you’ve got proof of major disease in your immediate family, your risk of developing bound conditions is far higher.

• Driving record: A history of moving violations or drunk driving will dramatically increase the price of insurance premiums.

insurance shopping for Guide

insurance applications usually need personal and family anamnesis and beneficiary information. you’ll also doubtless got to experience a medical exam. you’ll need to disclose any antecedent medical conditions, history of moving violations, DUIs, and any dangerous hobbies appreciate racing or skydiving.

commonplace styles of identification also will be required before a policy may be written, appreciate your Social Security card, driver’ license, and/or U.S. passport.

STEP three – Compare Policy Quotes

once you’ve assembled all of your necessary information, you’ll gather multiple insurance quotes from dissentent|completely different} suppliers supported your research. costs can differ markedly from company to company, therefore it’ vital to travel to the hassle to seek out the most effective combination of policy, company rating, and premium cost. as a result of life insurance are some things you’ll doubtless pay monthly for decades, it can save a vast quantity of cash to find the best policy to suit your needs.

Benefits of insurance

There are several advantages to having life insurance. Below are a number of the foremost vital options and protections offered by life insurance policies.

most of the people use life insurance to supply cash to beneficiaries who would suffer a monetary hardship upon the insured’s death. However, for rich people, the tax advantages of life insurance, as well as the tax-deferred growth of money value, nontaxable dividends, and tax-free benefits, will provide extra strategic opportunities.

Avoiding Taxes—the death benefit of a life insurance policy is typically} tax-free.1 rich individuals sometimes get permanent life insurance inside a trust to help pay the estate taxes that may flow from upon their death. This strategy helps to preserve the worth of the estate for his or her heirs. minimization may be a law-abiding strategy for minimizing one’s liabilities and may not be confused with tax evasion, that is illegal.

Who wants Life Insurance?

insurance provides financial backing to extant dependents or different beneficiaries when the death of AN insured policyholder. Here are some samples of those who may have life insurance:

• folks with minor children—if a parent dies, the loss of their financial gain or caregiving skills could produce a monetary hardship. insurance can confirm {the kids|the youngsters|the kids} will have the financial resources they have till they will support themselves.

• folks with special-needs adult children—for children who need womb-to-tomb care and can ne’er be self-sufficient, life insurance can make sure their wants are going to be met when their parents pass away. The benefit may be accustomed fund a special needs trust that a fiduciary will manage for the adult child’s benefit.2

• Adults who own property together—married or not, if the death of 1 adult would mean that the opposite might no longer afford loan payments, upkeep, ANd taxes on the property, insurance could also be a decent idea. One example would be an engaged couple who eliminate a joint mortgage to shop for their 1st house.

• Seniors who need to depart cash to adult kids who give their care—many adult children sacrifice time at work to worry for an old parent who wants facilitate. This help may embrace direct monetary support. insurance will help reimburse the adult child’s prices once the parent passes away.

• Young adults whose folks incurred personal student loan debt or cosigned a loan for them—young adults while not dependents seldom would like insurance, however if a parent are going to be on the hook for a child’s debt when their death, the kid might want to hold enough life insurance to pay off that debt.

• kids or young adults who want to lock in low rates—the younger ANd healthier you are, the lower your insurance premiums. A 20-something adult would possibly get a policy even without having dependents if there’s an expectation to own them within the future.

• lodge in home domestic partners – stay at home spouse ought to have life insurance as they need important amount supported the work they are doing within the home. consistent with Salary.com, the economic value of a lodge in home parent would are akin to AN annual earnings of $162,581 in 2018.

• rich families who expect to owe estate taxes—life insurance will give funds to hide the taxes and keep the total value of the estate intact.

• Families who can’t afford burial and ceremony expenses—a tiny insurance policy can provide funds to honor a idolized one’s passing.

• Businesses with key employees—if the death of a key employee, appreciate a CEO, would produce a severe monetary hardship for a firm, that firm might have AN interest that may enable it to get a insurance policy on it employee.

• Married pensioners—instead of selecting between a pension payout that provides a spousal benefit and one that doesn’t, pensioners will favor to settle for their full pension and use a number of the cash to shop for life insurance to learn their spouse. This strategy is termed pension maximization.

every policy is exclusive to the insured and insurer. It’s vital to review your policy document belowstand|to know|to grasp} what risks your policy covers, what quantity it’ll pay your beneficiaries, and under what circumstances.

issues Before shopping for insurance

analysis policy choices and company reviews—because life insurance policies are a serious expense and commitment, it’ crucial to try and do correct due diligence to form positive the corporate you select encompasses a solid memoir and monetary strength, provided that your heirs might not receive any benefit for several decades into the future. Investopedia has evaluated immeasurable corporations that supply all differing types of insurance and rated the most effective in numerous categories.

Life insurance may be a prudent monetary tool to hedge your bets and supply protection for your idolized ones just in case of death must you die whereas the policy is in force. However, there are things within which it makes less sense—such as shopping for an excessive amount of or insuring those whose financial gain doesn’t got to be replaced. So, it’ vital to contemplate the following:

What expenses couldn’t be met if you died? If your domestic partner encompasses a high income and you don’t have any children, perhaps it’ not warranted. it’s still essential to consider the impact of your potential death on a domestic partner and take into account what quantity financial backing they might got to grieve without fear about returning to figure before they’re ready. However, if each spouses’ financial gain is critical to take care of a desired life-style or meet monetary commitments, then both spouses may have separate insurance coverage.

If you’re shopping for a policy on another family member’ life, it’ important to ask—what are you making an attempt to insure? kids and seniors very don’t have any significant income to replace, however burial expenses might need to be coated within the event of their death. on the far side burial expenses, a parent may also need to shield their kid’s future eligibility by getting a moderate-sized policy once they are young. Doing therefore permits that parent {to ensure|to create sure|to confirm} that their child will financially protect their future family. folks are solely allowed to get insurance for his or her kids up to 25% of the in-force policy on their own lives.

might finance the cash that may be paid in premiums for permanent insurance throughout a policy earn {a better|a far better|a much better|a higher|a stronger|a a lot of robust|an improved} come over time? As a hedge against uncertainty, consistent saving and investing—for example, self-insuring—might make more sense in some cases if a major financial gain doesn’t need to get replaced or if policy investment returns on money worth are excessively conservative.

however insurance Works

A life insurance policy has 2 main components—a benefit and a premium. Term life insurance has these two components, however permanent or whole life insurance policies even have a cash value component.

1. Death Benefit—the death benefit or face value is that the quantity of cash the insurer guarantees to the beneficiaries known within the policy once the insured dies. The insured may be a parent, and also the beneficiaries might be their children, for example. The insured will opt for the specified benefit quantity supported the beneficiaries’ calculable future needs. The insurer can confirm whether or not there’s AN interest and if the projected insured qualifies for the coverage based on the company’s underwriting needs relating to age, health, and any dangerous activities within which the proposed insured participates.

2. Premium—premiums are the cash the client pays for insurance. The insurer should pay the death benefit once the insured dies if the policyholder pays the premiums as required, and premiums are determined partially by however doubtless it’s that the insurer will have to pay the policy’s benefit supported the insured’s lifespan. Factors that influence life expectancy embrace the insured’s age, gender, medical history, activity hazards, and speculative hobbies.3 a part of the premium additionally goes toward the insurance company’s operative expenses. Premiums are higher on policies with larger death benefits, people who are at higher risk, and permanent policies that accumulate money worth.

3. money Value—the cash value of permanent insurance serves 2 purposes. it’s a bank account that the client will use throughout the lifetime of the insured; the cash accumulates on a tax-deferred basis. Some policies might have restrictions on withdrawals looking on however the cash is to be used. For example, the client might eliminate a loan against the policy’s cash worth and ought to pay interest on the loan principal. The policyholder also can use the cash value to pay premiums or purchase extra insurance. The cash value may be a living profit that is still with the insurer once the insured dies. Any outstanding loans against the cash value can scale back the policy’s death benefit.

however does one Qualify forever Insurance?

insurance is out there to anyone, however the price or premium level will vary greatly supported the chance level a personal presents based on factors like age, health, and lifestyle. insurance applications usually need the client to supply medical records and anamnesis and experience a medical exam. Some kinds of life insurance appreciate bonded approval life don’t require medical exams but generally have a lot of higher premiums and involve an initial waiting amount before taking impact and providing a benefit.

however will insurance Work?

insurance policies all supply a death benefit in exchange for paying premiums to the insurance supplier throughout the term of the policy. One widespread sort of insurance—term life insurance—only lasts for a group quantity of time, appreciate ten or twenty years during that the client has to offset the monetary impact of losing income. Permanent life insurance additionally options a benefit however lasts for the lifetime of the policyholder as long as premiums are maintained and may embrace money worth that builds over time.